How to Show Proof of Income When Self Employed

Becoming a self-employed individual is a great step into independence and financial freedom. Over the last year alone, freelancing has risen 41% especially with the growth in technology and usage of the Internet.

We love to hear the stories of those that make this jump and eventually find their way on the road to success. You get to enjoy the spoils of a flexible schedule that so many desire. Unfortunately, there are a lot of aspects that we do not get to see on the road to the top. Many small little details have to be learned and mastered when you decide to take the business into your own hands.

One of the small details that get overlooked is having proof of income. An individual may think that because your income is not at a steady rate you may not be able to provide proper proof of income. However, it actually can be as easy as it is for a full-time employee, all it takes is staying organized and holding onto your records.

The biggest difference is that there is not an employer making sure all these aspects are in line for you because you are your own employer. You, being self-employed, have to learn the knowledge of what is needed and create a system that helps you manage it.

Hold On to Your Records

The most important piece to take away from this article is to hold on to all information pertaining to your business. With all the advances in technology we no longer need to physically hold on to paperwork but scanning copies of each is pertinent to keep tabs on business over the years.

You never know when you’ll need to pull a document from years prior in order to present it to the appropriate parties that are inquiring. The following information will tell you how to provide proof of income utilizing these kept documents.

How Persona Can Help

Persona as a platform can truly help any self-employed individual. These days a lot more people are making the change to being financially independent. The problem is they may have a lack of knowledge in the financial area as far as taxes.

Taxes are tricky for anyone to understand and Persona makes it so much easier as it tags both incoming and outcoming transactions. It even allows you to allocate a predetermined percentage of your incoming revenue towards taxes.

Amongst this feature, the app also assists with scheduling as clients can book and pay through a site distributed by the app. Most importantly, the app is free with no in-app fees either.

What is Proof of Income and Why Do You Need It?

Proof of income is basically as it sounds, literal proof that you made money in whatever time period was requested (usually a year). Usually, proof of income is requested by a lender or a landlord.

It is important to include all of your basic personal information so that you give a clear understanding of your earnings. Your earnings are made up of your average workweek hours, yearly salary, or hourly wage, and how you see this income will be sustained in the future.

The documents used to prove this vary and depend on which entity is requesting the proof. Some documents are more authoritative and credible than others.

Common reasons you may need to provide proof of income:

- Filing taxes

- Getting health insurance(you can read our full article about insurance for personal trainer)

- Applying for a credit card

- Leasing a car, apartment or house

- Financing a car

- Applying for a mortgage

- Any other types of personal loans

With the exception of the first listed (filing taxes), all of the reasons listed involve money being lent out. In order to lend out the money, the companies have to have some form of trust in you and they discover that trust through your proof of income. For example, if you are going to a bank for a loan they need to see that you are making money in some type of way so that they can know they have a good chance of recouping their investment into you.

Documents that Provide Proof of Income

A large benefit that an average employee has is their proof of income is within two documents, which are the W-2 and their latest bank statements.

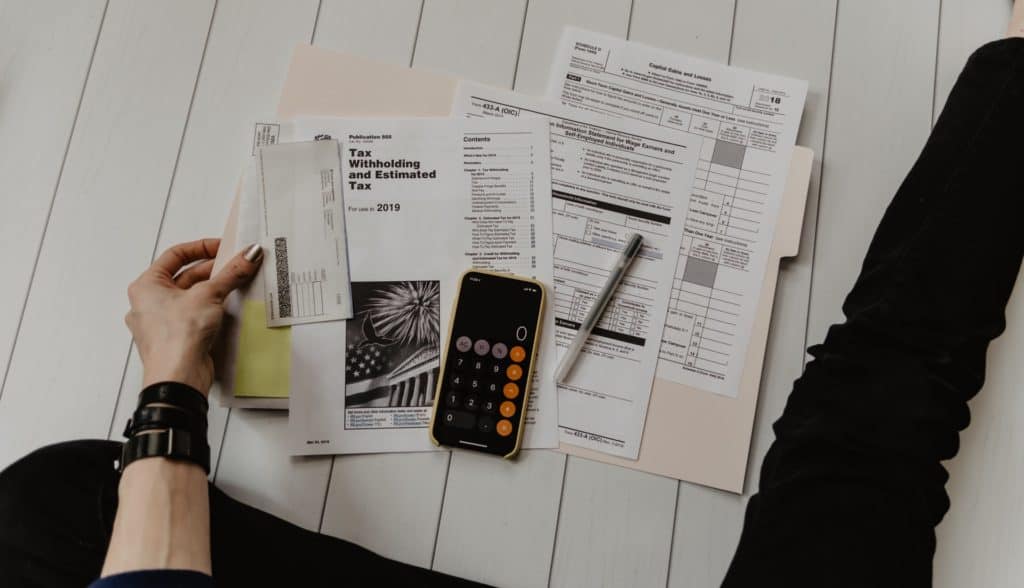

As a self-employed individual, you do not receive W-2s so you have to support your proof of income with other documentation such as:

- Annual Tax Return: This is hailed as the most straightforward and credible way to show proof of income. However, it is important to remember that you need to report every penny you made during that year so include bank statements for income not on 1099 forms.

- 1099 Forms: This is an official tax form sent to you from any party that paid you more than $600 throughout the year. The person that paid you is responsible for reporting this to the IRS. Also if they don’t, you should request a copy for yourself to reference for filing your own taxes. This form is a secondary way to prove your income in case you do not have your tax return. There are more than two dozen types of 1099 forms for various income purposes.

- Bank Statements: These come in handy in the case that you do not have a 1099 form that corresponds with income you received. The best course of action is to have separate accounts for business and personal, but if you do not, you need to have to make a clear distinction between the two.

- Profit/Loss Statements: This document provides the requesting party with the overall revenue, cost and profit you made from being self employed.

- Self Employed Pay Stubs: Utilizing a pay stub generator or even by yourself, you can create pay stubs for record keeping and demonstrate proof of income. The self pay stub has to include gross pay, deductions, and net pay.

Keeping Yourself Organized

Previously we’ve mentioned the documents that it takes to show proof of income but all of that documentation can be overwhelming to manage for a single person, especially since you are handling your own business. Keeping your documents organized can save you a big headache for the situations when they are requested.

For example, a person doing contracting work may receive several 1099 forms from the various jobs they’ve performed throughout the year. If this person were to mismanage the organization of these documents, forget to file them, or lose them then it can be tricky to get them back.

Usually, the 1099 form has two copies (one given to you and one the payer filed) but nobody would want to have to track down the payer to get information that they should have for themselves. Tracking someone down can be time-consuming as you may be in a time crunch and the other party may not be able to get you what you need in the timeframe necessary.

In examples like this, it shows how inconvenient your life can get if you don’t stay organized. Thus it’s best to always keep originals and copies of important documents and paperwork. Most would recommend using your computer for safe storage that doesn’t take up any physical space, however, one must think of preserving physical copies because technology is not perfect. A computer, though unlikely, can get a bad virus and terminate all of your files. The safest bet is to use both computers and a filing cabinet for storage.

Hiring Help

A more expensive option is to hire help to aid in maintaining all of your financial records as a self-employed individual. Hiring a worker such as an accountant can make your life significantly easier because it leaves you with nothing to keep track of on your own. The job of taking every document and filing all paperwork would fall on their shoulders while you maintain focus on pursuing your work full time.

Though this seems like the easiest option, it is costly because you are essentially hiring an employee. You will have to pay them for their work. Also, you have to find time to check in with them consistently or you will be uninformed of what the financial status of your business currently is.

Further, as you know, not everyone has you and your business’s best interest at heart, so you will have to always keep a peripheral eye on the person’s work ethic. Hence, you need to thoroughly decide if you really need to have an accountant because you are totally consumed with your work or if you are just trying to avoid a little bit of extra work.