How to Accept Payments as a Freelancer

Research shows an increasing number of Americans are choosing to freelance as a way to earn income and that’s why the freelance industry is booming. Freelancers are in demand and they’re making a lot of money.

According to Flexiple, at a growth rate of 78 percent year over year, the freelance economy in the United States is said to be expanding at the fastest pace. Why? Because they can set their own hours, work from anywhere, and choose what type of projects to take on.

But the tradeoff is that freelancers have to handle all aspects of running a business themselves: marketing themselves; finding clients; negotiating fees; doing the work itself – everything! That means it can be tough going if you don’t know how to accept payments as a freelancer without getting scammed or falling into debt!

So in today’s article, we’re going to go over some of the best ways how to accept payments as a freelancer safely and securely

How Do Freelancers Get Paid?

The best ways to get paid as a freelancer depend on the type of work you do, your location, and the payment method(s) your clients prefer. But in general, the process of getting paid as a freelancer is:

- Get an estimate or proposal approved by your client.

- Deliver the work as agreed upon.

- Invoice your client for the work performed.

- Wait for payment to arrive in your bank account (or other designated account).

- Pay applicable taxes on your income.

Related: How to Collect Payments as a Personal Trainer

6 Best Payment Options for Freelancers to Get Paid Fast & Securely

So how to receive payment as a freelancer? Here are six of the best ways:

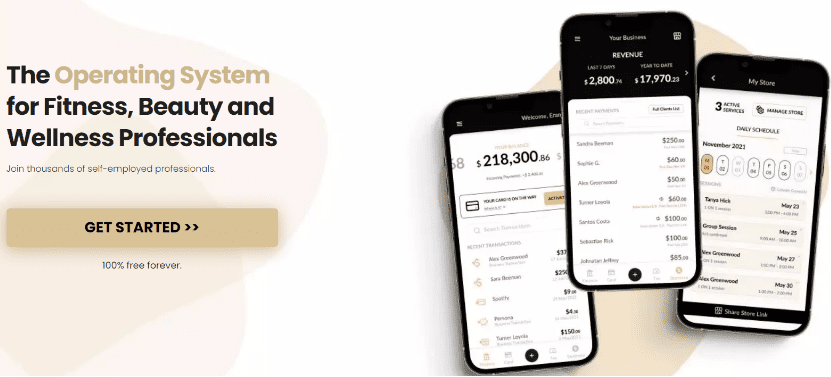

1. Persona – Get Free Transfers and Incoming Wires

Persona is the perfect payment processing and scheduling solution for freelancers in the beauty, fitness, and wellness industries! With Persona, you can easily accept payments and schedule sessions without any hassle.

In order to initiate payment for services rendered, you can send an invoice and payment request via email. This app can send reminders to your clients as needed while keeping your business running like a well-oiled machine with payment processing that is easy and efficient.

What’s more from Persona?

- No setup fees

- No monthly fees

- 100% free forever for every user

- Cancellation fees are a thing of the past

- Email invoicing and payment requests

- Automated payment reminders & hassle-free scheduling

- Quick & very easy payment processing

- Provide business analytics for your growth

- Get a virtual card immediately

- Super-intuitive mobile app

- Human customer support is available 24/7

2. Square

Square is a great option for small businesses that need to keep track of their hourly employees. It’s affordable and easy to use, and it can manage things like schedules, time-tracking, taxes, and benefits.

Square is a company that not only offers affordable and flexible options for contractors but also provides transparency in pricing with its contractor-only plan. They stand out from the competition by allowing you to choose how much money you want on your every month – whether it be all of it at once or just some – as well as other payment methods such as credit or debit cards.

- Straightforward pricing

- Hourly employees only

- You’re in control

- Flexible payment options

- Cost-effective contractor-only option for small teams.

3. Wave

Wave is a cloud-based financial management solution, so your data is kept on Wave’s servers and sent to your platform over the internet.

It offers a processing option for smaller businesses with fewer than five employees. It’s a good fit if you have seasonal workers, or plan on using Wave Accounting in the future!

Wave Accounting and Wave were designed to work together, allowing for automatic recording of any financial transaction.

- No per-employee fees

- Easy to use

- Great for small businesses

- Option to integrate with Wave Accounting software

- Automatic journal entries

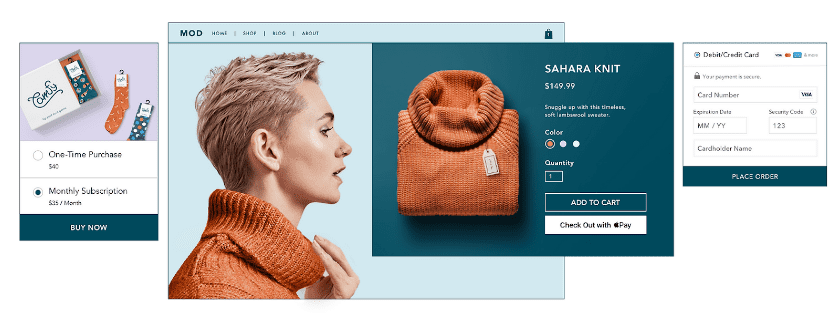

4. Wix Pay

Wix Pay is a great way to accept payments on your website. It’s easy to set up and use, and it’s perfect for businesses that want to start taking payments online quickly and easily.

All you need is a Wix account and to add the Wix Pay button to your website.

Wix Pay is perfect for businesses of all sizes, and it’s a great way to start taking payments online quickly and easily.

The platform has already proved to be quite popular, with 8 out of 10 new Wix customers now utilizing it as their processor. Wix Payments uses industry-leading security measures to safeguard their customers’ financial transactions, which are governed by the Payment Card Industry Data Security Standards.

- It’s quick and painless to put together.

- Online payments are safe and secure.

- Credit cards, debit cards, and other online payment options are accepted.

- Payouts, refunds, and chargebacks are all handled through the same dashboard.

5. PayPal

Freelancers frequently use PayPal as a means of payment. It’s quick and easy to create an account, and clients may pay you immediately after they receive your invoice. The money is immediately credited to your PayPal account, and you may then quickly transfer it to your bank account. Unless you pay additional costs for quick bank transfer, transfers to your bank account are free.

- You can also use PayPal to pay for goods and services online.

- Quick and easy to set up an account.

- You can use a PayPal debit card to withdraw funds from your PayPal account and spend them immediately.

6. Zelle

Zelle is a free, simple-to-use payment service provider that lets you move money fast. You can now send money directly between two bank accounts using this mobile peer-to-peer payment software.

You don’t need to know the recipient’s bank account information to use Zelle to send money. Instead, you may send it using their phone number or email address. Zelle will send a text message or email to let them know there’s a payment ready in their Zelle account.

- Free and fast

- Accept credit card payments

- Compatible with many banking apps

- Secure transactions

- You do not need the recipient’s banking information.

- There are no restrictions on how much you can receive.

Worth Reading: Time Management Tips for Freelancers

What Should You Consider When Choosing How to Get Paid?

As the saying goes, when it comes to how to receive money as a freelancer, there’s no one-size-fits-all answer. You’ll need to consider a variety of factors to decide which payment method is best for you:

- What payment methods does your client prefer?

- Do you want to receive payments in a certain currency?

- How often do you need to be paid?

- Is there a minimum or maximum amount you’re willing to accept for each payment?

- What are the fees associated with each payment method?

- Are there any restrictions on how you can use the payment method (e.g. can you only use it to withdraw money from a bank account)?

- How safe and secure is the payment method?

- Does the payment method have any built-in features that could help you manage your finances (e.g. invoicing, tracking payments, etc.)?

- How easy is it to use the payment method?

- Is there customer support available if you need help using the payment method?

Tips For Getting Paid as a Freelancer

Truly getting paid as a freelancer takes more than just having a payment method in place. You’ll also need to:

- Send invoices promptly – Don’t wait until the end of the month to send an invoice for work that was completed two weeks ago!

- Be clear about your payment terms – Let your clients know what methods of payment you accept when payment is expected, and any late payment fees you may charge.

- Keep good records – Use financial software or app to track your income with proof and expenses, so you can stay on top of your finances.

- Be proactive about chasing payments – If a payment is overdue, don’t hesitate to reach out to your client to find out what’s taking so long.

- Be patient – Sometimes it can take a while for payments to go through, especially if your client is in a different time zone or country.

- Remember to pay taxes on your income – You’ll need to file a tax return each year and pay taxes on the income you earn as a freelancer.

Also read: How to Increase Prices Without Losing Customers

Frequently Asked Questions

Do freelancers need invoices?

Yes, invoices are a necessary part of getting paid as a freelancer. Your clients will need an invoice to make a payment to you.

When should you invoice as a freelancer?

As a freelancer, you should invoice as soon as you have completed the work for which you will be billing your client. This will help ensure that you’re paid on time.

What should I include in a freelance invoice?

Your invoice should list the following information:

- The date of the invoice.

- The client’s name and address.

- The contact information for the person who should receive payment.

- A description of the services or products provided.

- The amount owed.

- The payment terms (e.g. when payment is expected, any late payment fees)

How many days should I wait before following up on an invoice?

If payment is overdue, you should follow up with your client within a few days. However, be aware that some payments may take longer to process, so be patient.

How long does it take to get paid as a freelancer?

It can take anywhere from a few days to a few weeks for local as well as international payments to go through, depending on the payment method used and the country of your client.

Conclusion

There are a variety of payment methods available to freelancers, so it’s important to choose the one that best suits your needs. By taking the time to consider the factors listed above, you can make sure that you’re getting paid in a timely and efficient manner.

If you are a self-employed business owner, Persona is the perfect payment solution for you! Persona is a business and financial management application designed particularly for fitness, beauty, and wellness professional who are self-employed. Plus, their payment methods are secure and easy to use, so you can focus on what you do best – helping your clients look and feel their best!